tax deferred exchange definition

Sometimes people say tax-free exchange. Tax Deferred Exchange has the meaning set forth in Section 108A hereof.

What Is A 1031 Exchange Asset Preservation Inc

Reverse Tax-Deferred Exchange is a reverse tax-deferred like-kind exchange pursuant to section 1031 of the Internal Revenue Code of 1986 as amended and Revenue Procedure.

. Define Headquarters Property Tax Deferred Exchange. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. Build Your Diversified Portfolio Of Institutional Real Estate Using IRC 1031 Exchanges.

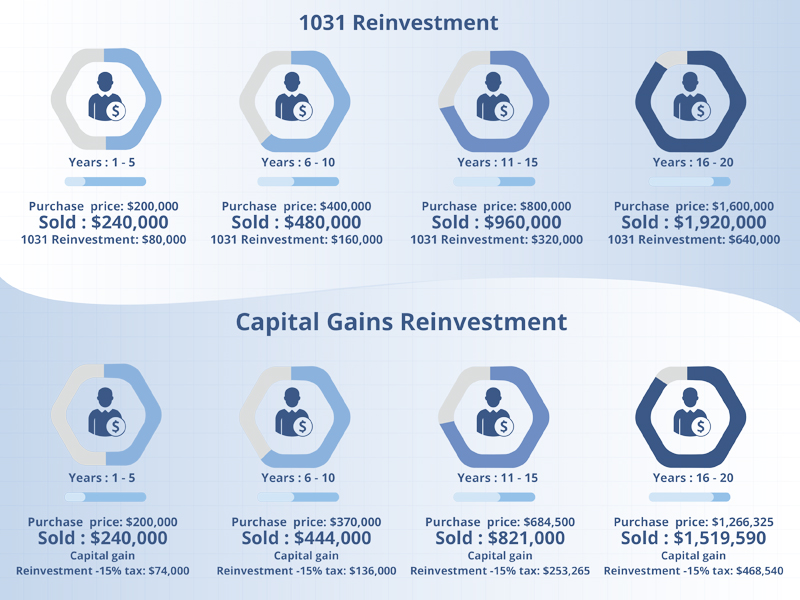

A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain. In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange. More Capital Gains Tax.

If a lender is used to provide the loan be sure the. Ad Diversify Your Investment Portfolio with a Tax Deferred DST Property Exchange. Explore How To Use ETFs with iShares Today.

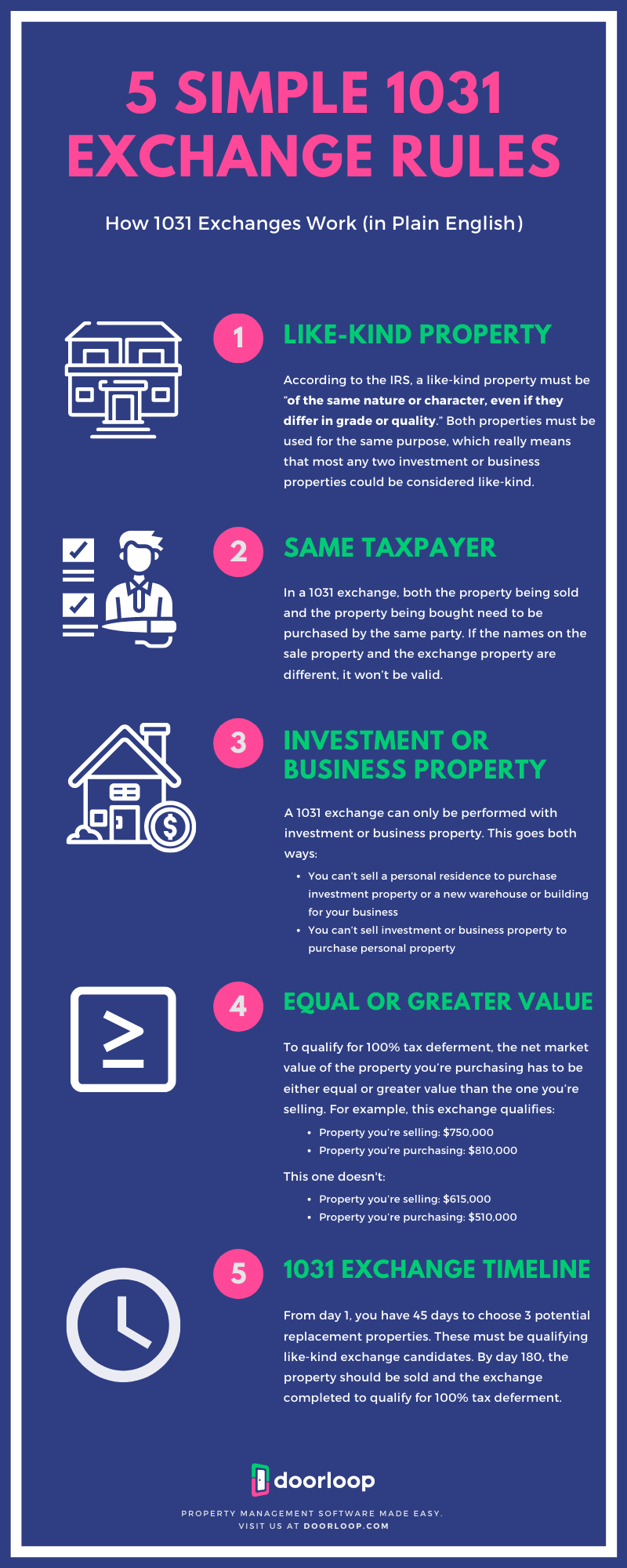

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. Is determined by expansive definition of like-kind similar. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

Ask the team of 1033 tax-deferred exchange specialists at Exeter 1031 Exchange Services LLC and we WILL get you an answer. A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that. Means a series of transactions effected as part of the previous acquisition by the Borrowers of certain of the assets of Saks.

Ad With Decades Of Experience Let Cornerstone Help With Your 1031 Exchange Today. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. Get Your Free Time Back w Passive DST Investments.

Legal Definition of tax-deferred. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third. Ad Your Investment Goals Are Unique.

Tax-Deferred Exchange in United States Tax-Deferred Exchange Definition 1031 Exchange in this Legal Encyclopedia1031 Exchange definition in the Law Dictionary. Tax Deferred Exchange shall have the meaning set forth in. Define Reverse Tax-Deferred Exchange.

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. Tax Deferred Exchange is defined in Section 125. By completing an exchange.

Establish funding to acquire your replacement property The funds may come from your exchange personal funds or a banklender. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties. The gain may be taxable in the current year while any losses the taxpayer suffered.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Those taxes could run as. Not taxable until a future date or event as withdrawal or retirement.

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Tax Deferral How Do Tax Deferred Products Work

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

:max_bytes(150000):strip_icc():gifv()/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

Are You Eligible For A 1031 Exchange

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

What Is A 1031 Tax Deferred Exchange Kiplinger

1031 Exchange When Selling A Business

1031 Tax Deferred Exchange Explained Ligris

Like Kind Exchanges Of Real Property Journal Of Accountancy

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

What Is The Benefit Of Tax Deferred Growth Great American Insurance

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)